The Basics of CFD Trading: How It Works and What You Should Know

The Basics of CFD Trading: How It Works and What You Should Know

Blog Article

What You Need to Know About CFD Trading to Succeed

Contract for Big difference (CFD) trading presents investors a distinctive solution to industry economic markets without possessing the main asset. It's received acceptance for the freedom and prospect of high earnings, but like any trading process, it requires ability and understanding to succeed. Whether you're a beginner or seeking to improve your strategy, below are a few expert methods and techniques to help you make the most of cfds.

1. Understand the Essentials of CFD Trading

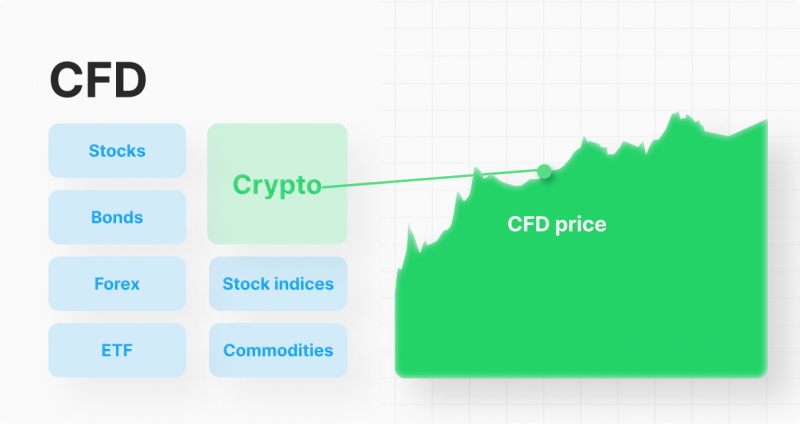

CFD trading lets you imagine on the purchase price motion of resources such as for example stocks, commodities, forex, and indices. Once you enter a CFD deal, you are agreeing to change the difference in the buying price of a property between enough time you open and shut the contract. This implies you are able to profit from both climbing and falling markets.

Before moving in, it's essential to really have a strong knowledge of how CFDs function, as well as the associated risks. Make an effort to familiarize your self with essential phrases and concepts such as spread, profit, and agreement styles to help make knowledgeable trading decisions.

2. Employ Flexible Control Properly

One of the very most attractive features of CFD trading is variable control, allowing traders to manage bigger jobs with a smaller capital outlay. However, while influence may increase profits, additionally, it magnifies possible losses. Use power cautiously and guarantee you are confident with the level of chance it introduces into your trading.

3. Create a Risk Administration Technique

An excellent chance administration strategy is a must in CFD trading. Generally collection stop-loss orders to restrict possible deficits and protect your capital. Moreover, determine the total amount of money you are ready to chance per industry and stick to it. Never chance more than you are able to reduce, as trading inherently holds some amount of risk.

4. Remain Current with Market Information

CFD prices are highly influenced by market media and global events. Keeping up-to-date on financial reports, geopolitical developments, and market sentiment can help you assume value movements. Use trusted information places and consider adding fundamental examination in to your trading strategy to make better-informed decisions.

5. Choose the Right Markets to Business

CFD trading supplies a wide range of markets to business, but not totally all areas may possibly suit your trading style. Some markets tend to be more volatile, giving larger potential gains but additionally greater risks. Others are more stable, which might suit risk-averse traders. Evaluate the market conditions and pick those that align with your risk patience and strategy.

Conclusion

CFD trading can be quite a gratifying knowledge when approached with understanding and strategy. By knowledge the basic principles, applying power responsibly, handling chance, and staying informed, you can increase your likelihood of success. Remember, trading is just a ability that improves eventually and experience, so have patience and continue understanding as you go. Report this page